Who we are

Created in 2019 in Paris and Geneva, Passy Invest is an independent financial advisory firm specialized in Real Estate Private Debt.

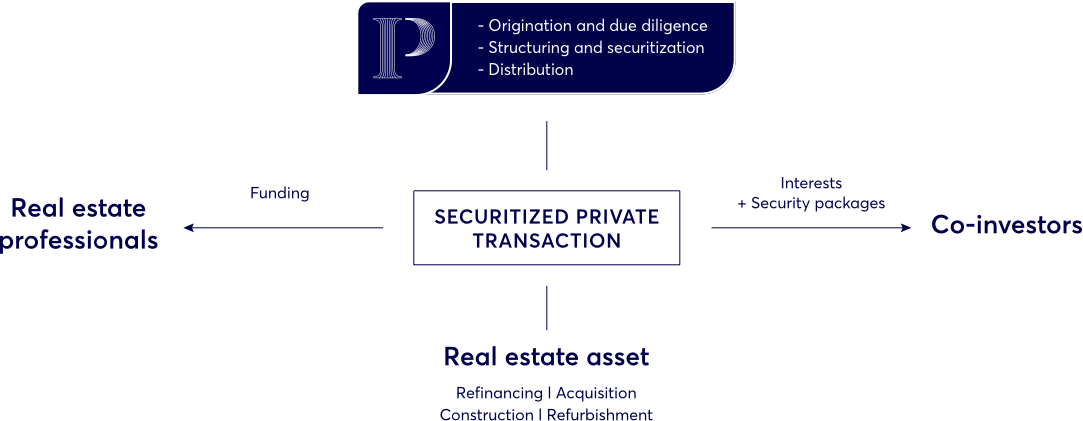

Our approach

EASED ACCES TO EXCLUSIVE PROJECTS FOR PROFESSIONAL INVESTORS

Our objective is to build a unique a Real Estate Private Debt platform to provide investors with under-radar investment opportunities with diversifying risk/return profiles.

Leveraging our experience in financial markets and our strong origination capacity, we intend to select and propose professional investors with institutional investors quality grade projects.

A FLEXIBLE PARTNER WITH ACCES TO CAPITAL

With a creative approach, we identify investment opportunities at early stage and deliver a tailor-made, best-in class investment solutions.

With Passy Invest you can rely on an agile partner with the ability to advise and structure the most suitable financing solution.

As finance and real estate experts we understand the difficulties faced by project sponsors to fulfill their funding needs and by investors to properly identify and select their next private investments.

Passy Invest intends to simplify your access to the private market.

Our values

Focus

Your time is precious.

We only focus on few transactions

at-a-time to deliver a tailor made service.

TRUST

It’s all about it.

We always favor long term transactions and compliance over short term gains - it’s over decades, not just over years.

AGILITY

Managing the unexcepted.

We constently adapt ourselves to shifts and trends with a high level of reactivity.

Closed Transactions

Co-investment with a PE fund

10mEur bond issuance backed by a portfolio of existing assets to finance the developpment of a Real Estate asset manager

Junior Financing

4mEur financing to transform a 4511 sqm office building located in Paris into a residential property by a large asset manager

Mezzanine financing

12mEur Mezzanine Financing for the acquisition of 2,000 sqm plot in the center of Paris by a french real estate developper

Wholeloan

7mEur secured private debt to finance the acquisition of a plot located in Luxembourg and the construction of 4 villas