A robust framework for a seamless execution of your transactions

As each transaction is specific, we have built a dedicated structuring team with a trustworthy network and a proprietary toolbox to ensure an efficient and easy execution.

A strong network of institutional partners

PROJECTS SOURCING

Origination is crucial. Thanks to our network developped over our past experiences, we source off-market deals that may be difficult to access for traditional investors

INSTITUTIONAL PARTNERS

We have developped partnerships with first class institutions that help us to execute our transactions : law firms, fiduciary, bondholder representatives, security trustee, paying agent, accounting and valuation firms

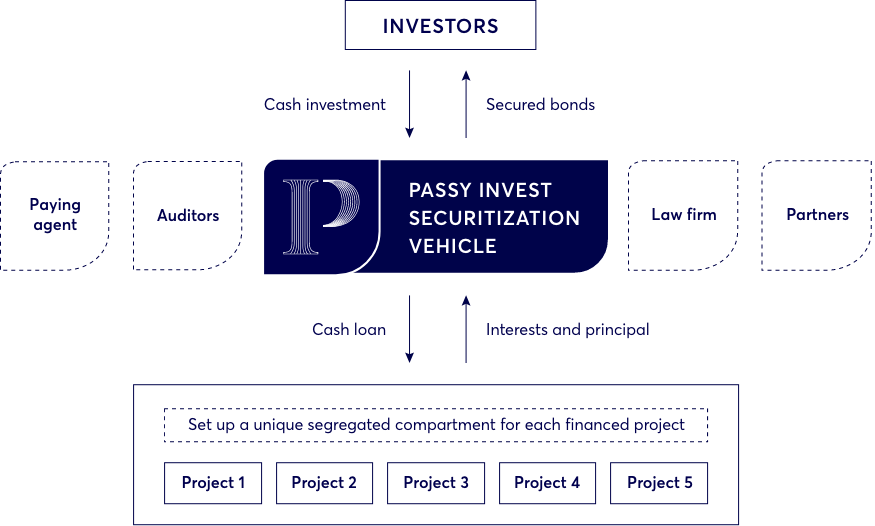

A proprietary issuing investment vehicle

Based in Luxembourg

A sound legal framework : thanks to the March 2004 Luxembourg Securitization law, Luxembourg is an attractive and tested marketplace for securitizations ensuring enhanced investor protection.

Compartmentalization : each compartment corresponds to a specific asset and is legally ringfenced from the others. The bankruptcy remoteness principle separates the securitized assets from any insolvency risk of the issuance vehicle, the originator, the service provider or any other involved party.

Flexibility : A tailor made investment and financing solution.

Securitization

A robust framework with solid institutional partners