Simplifying Real Estate Private Investments

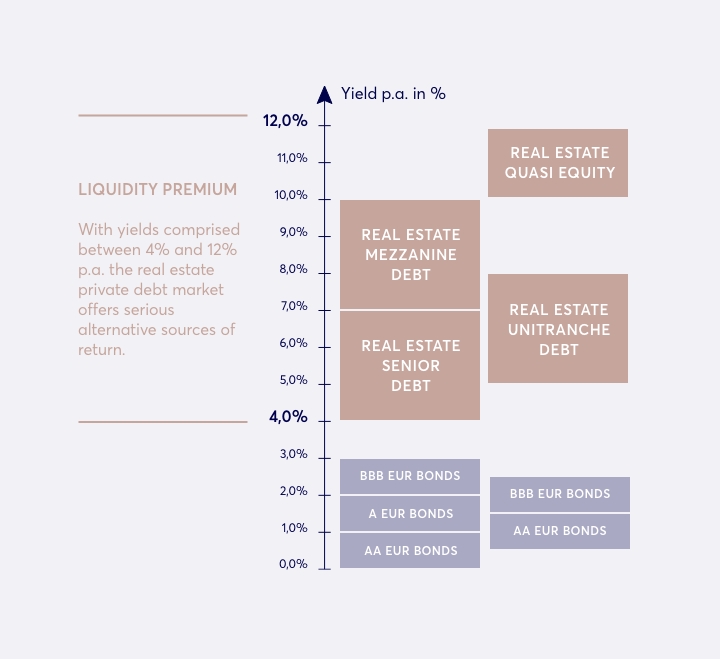

In a context of low yield and high inflation, Private Debt offers a very compealing alternative to traditional fixed income solutions: a high coupon, over a short duration, with a tangible guarantee and collateral.

Our services

to professional investors

ORIGINATION & SOURCING

Whilst these asset classes have traditionally only been within reach of institutional investors, Passy Invest private debt experience and origination capacity enables professional investors to access such transaction in a securitized format.

ANALYSIS & DUE DILIGENCE

With an extensive knowledge and track record of structuring, we place due diligence at the heart of our priorities to offer full transparency to our potential investors.

Simplifying access to private investments

A selective approach

Projects diversity and complexity make the selection difficult and time consuming for investors.

We are highly selective, we choose only sponsors and projects with a solid track-record and strong economics.

Regular flow of opportunities

Projects are kept under the radar and Investors don’t have the chance to access these opportunities.

With a platform driven approach, we provide our investors network with numerous projects and transactions.

Eased access

Access to projects can be limited to few institutional investors with high minimum requirements.

We offer access to private deals to qualified investors with a minimum investment as low as EUR 125k.

Transparency

Everything needs to be crystal clear.

We provide investors with regular information about their investments :

factsheet, investment memo, detailed business plan, independent valuation ...

For profesionnal investors

In the current market environment, we have identified real estate private debt as a niche offering compelling risk reward and diversification for co-investors.

While private markets are generally long term investments, real estate private debt suits investor with a short-term horizon.

- SHORT DURATION : 12 to 36 months

- ATTRACTIVE RETURN : 6% to 12% coupon

- COLLATERAL : strong security package over tangible assets

- DIVERSIFICATION & LOW VOLATILITY : strong decorrelation from financial market, i.e. the note do not fluctuate and contribute to the stability of investors portfolio

- EASED ACCESS thanks to securitization

Private investments vs Bonds return comparison