Securities over tangible assets

A downside risk limited by a recourse over tangible assets.Securities over tangible assets

Almost 95% of the publicly traded bonds are unsecured.

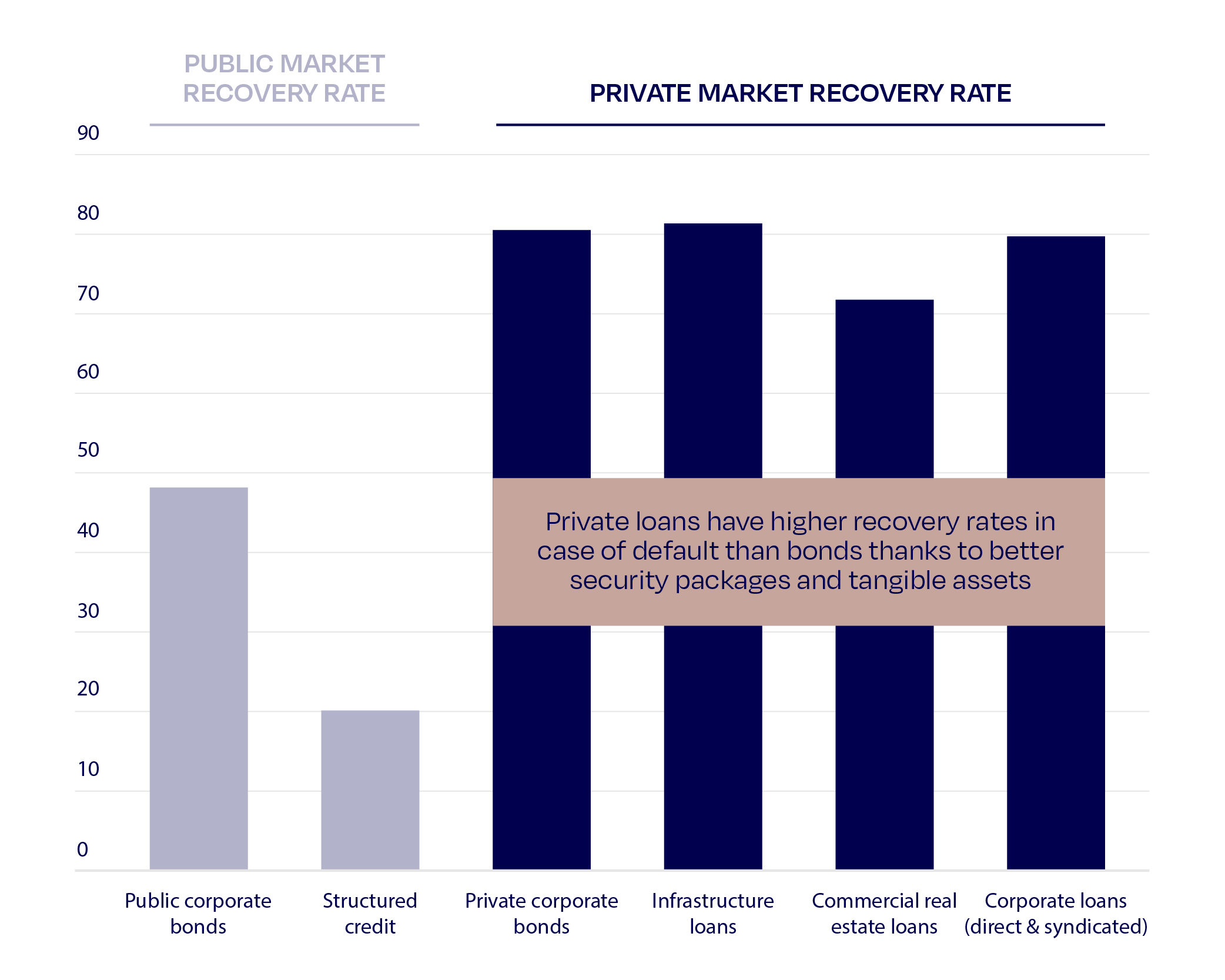

In addition to their interesting yield, another main advantage of real estate debt instruments compared to traditional bonds is that they typically include security packages over tangible assets:

- In case of default of the borrower, investors typically benefit from a recourse over the underlying asset

- Bondholders’ representatives: Compared to direct investments, private debt instruments allow for bond holder representative who would manage the liquidation in case of default.

Compared to traditional listed instruments, private loans offer often better recovery rates in case of default of the borrower.

*Source: Aberdeen Standard Investments, 2019.