An alternative financing solution

2009 Liquidity Crisis and capital requirement for banks created a need for private financing Assets...An alternative financing solution

2009 Liquidity Crisis and capital requirement for banks created a need for private financing Assets and returns have increasingly shifted towards the private market.

The Global Private Market Size has tripled in 10 Years from USD 275bn (2009) to USD 880+ Bn (2020).

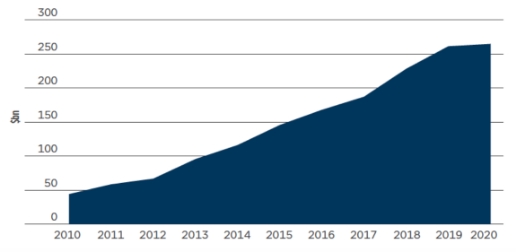

In Europe only, AuM increased by more than 5 times in 10 years. From <USD 50Bn in 2010 to USD 263bn in 2020.

What’s next?

According to Amundi*: « Market growth has been exceptionally strong over the past five years, recording double-digit three-year growth rates. This trend should continue over the mid/long term. According to a Preqin investor survey for the second half of 2020, 48% of investors anticipated to maintain or increase their allocation to private debt in the short term. »*

*Source: Amundi, Investing in post Covid 19, European Private Debt Market, March 2021